Like in every other country, getting a bank account in the U.S. for the first time can be confusing for a non-resident.

You will have to understand the required documents, minimum deposit amount, and many other things that are probably strange to you. If you find yourself in this state, don’t panic; we’ve got your back.

This guide will explain in great detail all you need to know about how to open a bank account in the U.S. as a non-resident. We’ll answer all the questions regarding documentation and also tell you about the costs, fees, deposits, and everything else.

Let’s begin by answering why you should care about owning a U.S. bank account even if you are not a citizen or permanent resident.

Why Open a U.S. Bank Account as a Non-Resident?

Opening a U.S. bank account as a non-resident will give you access to a wide range of benefits and save you lots of stress. You’ll be able to use debit cards for transactions, get instant paycheck deposits, pay bills, and even obtain a loan if you need to.

All these benefits are practically impossible to access if you only own an international account that is domiciled in your home country and currency.

Meanwhile, it is worth mentioning that opening a U.S. bank account as a non-resident is totally legal everywhere in the United States. So, feel free if you ever want to make an inquiry about the offerings of a U.S. bank or financial institution.

Keep in mind that some banks restrict their services to only U.S. citizens and individuals with a permanent U.S. address. But there are banks and institutions that extend a welcoming hand to non-residents, provided they possess a Social Security Number (SSN).

In many cases, you might be required to pay a visit to a physical branch in order to complete the account setup. The specific guidelines can differ from one bank to another, so your best course of action would be to directly get in touch with your chosen bank and explore the options available to you.

Documents Needed to Open a U.S. Bank Account as a Non-Resident

When it comes to opening a bank account in the United States, the requirements can vary significantly from one bank to another. Some institutions may request evidence of both a U.S. and foreign address, while others could be more flexible in their approach.

The specific documentation you’ll need for account opening can also depend on whether you are applying in person or online.

These are the possible requirements you will be asked to present:

- Proof of a U.S. address.

- Evidence of a foreign address.

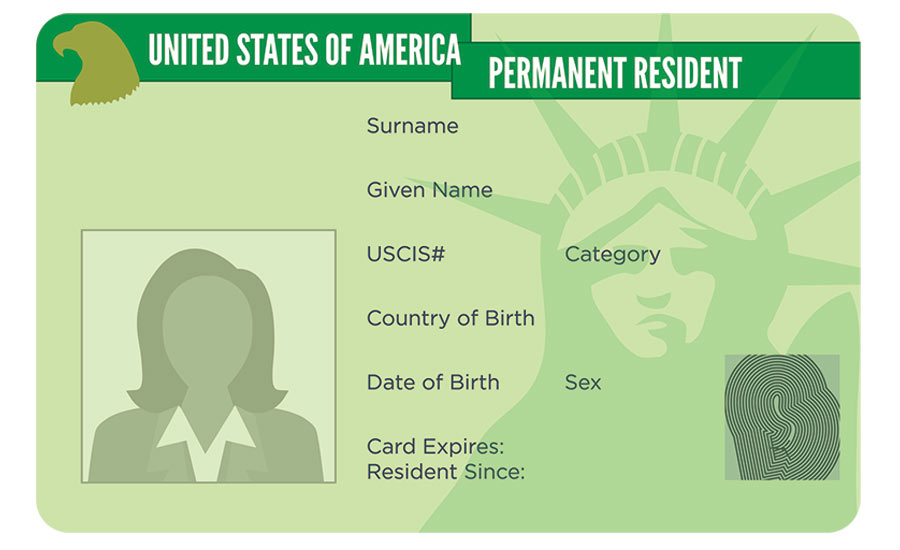

- Immigration documents.

- Proof of income.

- Social Security Number (SSN) or an individual taxpayer identification number (ITIN).

- A valid driver’s license, passport, or other official government identity document.

- Debit/credit card from your home country.

- Initial deposit payment.

Keep in mind that these documents may be categorized as primary or secondary, and the exact requirements can vary from bank to bank.

In most cases, you should expect to provide some form of identification, such as a passport or driver’s license, along with proof of address.

How Do You Find the Required Documents as a Non-Resident?

Well, you should already have some of the required documents if you got an approved Visa before coming to the U.S.

By default, you should have a valid driver’s license, international passport, or any other official government identity document. Similarly, you should have a valid proof of income and a debit/credit card from your home country.

Once you have all that in hand, the remaining documents should be easier to identify or obtain if you don’t have them at all.

Here’s a quick guide on how to get the other requirements ready.

1. Proof of Address

You can obtain official proof of your address from several sources, but it must be in the form of recognized documentation that is acceptable by U.S. banks. Here are some good examples:

- Student enrollment records

- Utility bills

- Existing bank statements

- Lease agreements

2. Social Security Number (SSN)

Social Security numbers comprise nine unique digits issued by the U.S. government to monitor an individual’s income and assess their qualification for specific social security benefits.

You can apply for an SSN through various methods:

- During your visa application process.

- Completing the SS-5 form.

- When applying for employment authorization.

3. Individual Taxpayer Identification Number (ITIN)

If you happen not to be eligible for an SSN, an alternative is to apply for an ITIN (Individual Taxpayer Identification Number) for tax processing.

You can easily access Form W-7 online and proceed with the application either electronically or in person. Typically, you can expect to receive your ITIN by mail within approximately seven weeks.

How Quick Can a Non-Resident Open a U.S. Bank Account

In all honesty, the process of obtaining a U.S. bank account for a non-resident is usually longer than usual. You will have to endure stricter background checks and check all the boxes in terms of required documents.

Here are some of the major factors that determine how quickly you can get your U.S. bank account.

- Having the necessary documentation

- Which bank you are applying to

- Whether you are applying from overseas or you are already in the U.S.

- How long you’ve been in the U.S.

- Applying in person or online

- Type of account you are applying for

Applying for a bank account is typically more straightforward when you’re already residing in the U.S. and can personally visit a bank. However, if this isn’t a viable option and you need to open an account before arriving in the country, the process may take a bit longer to finalize.

Types of U.S. Banks

When it comes to opening a bank account in the United States as a non-resident, you have a range of options to consider. Firstly, you’ll want to decide between opening a checking or savings account.

A checking account provides a secure place to hold your funds, easily accessible via a debit card for everyday transactions. On the other hand, a savings account is ideal for gradually building up your savings over time. If your stay in the U.S. is long-term, you might find value in having both types of accounts.

Once you’ve made that choice, the next decision is the type of bank you want to work with. Here are some of the most common options to consider:

- Local Banks: These banks cater to a specific state or region and are ideal if you won’t be conducting extensive banking activities outside your immediate area. Meanwhile, local banks are generally less likely to accommodate overseas account openings.

- Online Banks: These banks operate exclusively online and don’t have physical branches or in-person services. Typically, they only accept applications from U.S. residents.

- International Banks: These are well-established institutions like HSBC, Citibank, and Barclays. They often provide you the luxury of setting up a U.S. Dollar account with them even from your home country.

- Traditional Banks: Traditional U.S. banks primarily serve domestic customers. If you’re looking to open an account with a traditional U.S. bank, a visit to the U.S. in person is usually necessary.

- Correspondent Banks: In your home country, there may be banks that have partnerships with U.S. banks. Even if they aren’t international banks, these correspondent banks can help you set up an account in the U.S. You can inquire from your home bank about such partnerships.

Quick Note: some popular U.S. banks that often allow opening an account without SSN include Bank of America, Wells Fargo, HSBC, TD Bank, Citibank, US Bank, and Chase Bank.

Meanwhile, the banks that usually offer accounts to non-U.S. residents include JPMorgan Chase, Bank of America, and Citibank.

What’s the Cost of Opening a U.S. Bank Account?

Opening a bank account is usually free, but there are some fees you might have to pay down the road. These fees are often charged monthly or per transaction. Here are some of the most common bank fees in the US:

- Monthly maintenance fee

- ATM fees

- Overdraft fees

- Foreign transaction fees

- Late payment fees

- Check processing fees

- Stop payment fees

- Account closure fees

It’s important to read your bank’s fee schedule carefully so you know what you’re getting into. You may be able to avoid some fees by meeting certain requirements, such as maintaining a minimum balance or setting up direct deposit.

You should also keep in mind that using a specialized money transfer service is often the faster, more convenient, and cheaper way to send money overseas than a traditional bank-to-bank transfer.

Meanwhile, feel free to contact us here at PTMA for more guidance on how to open a bank account in the U.S. as a non-resident. We’d love to hear from you.